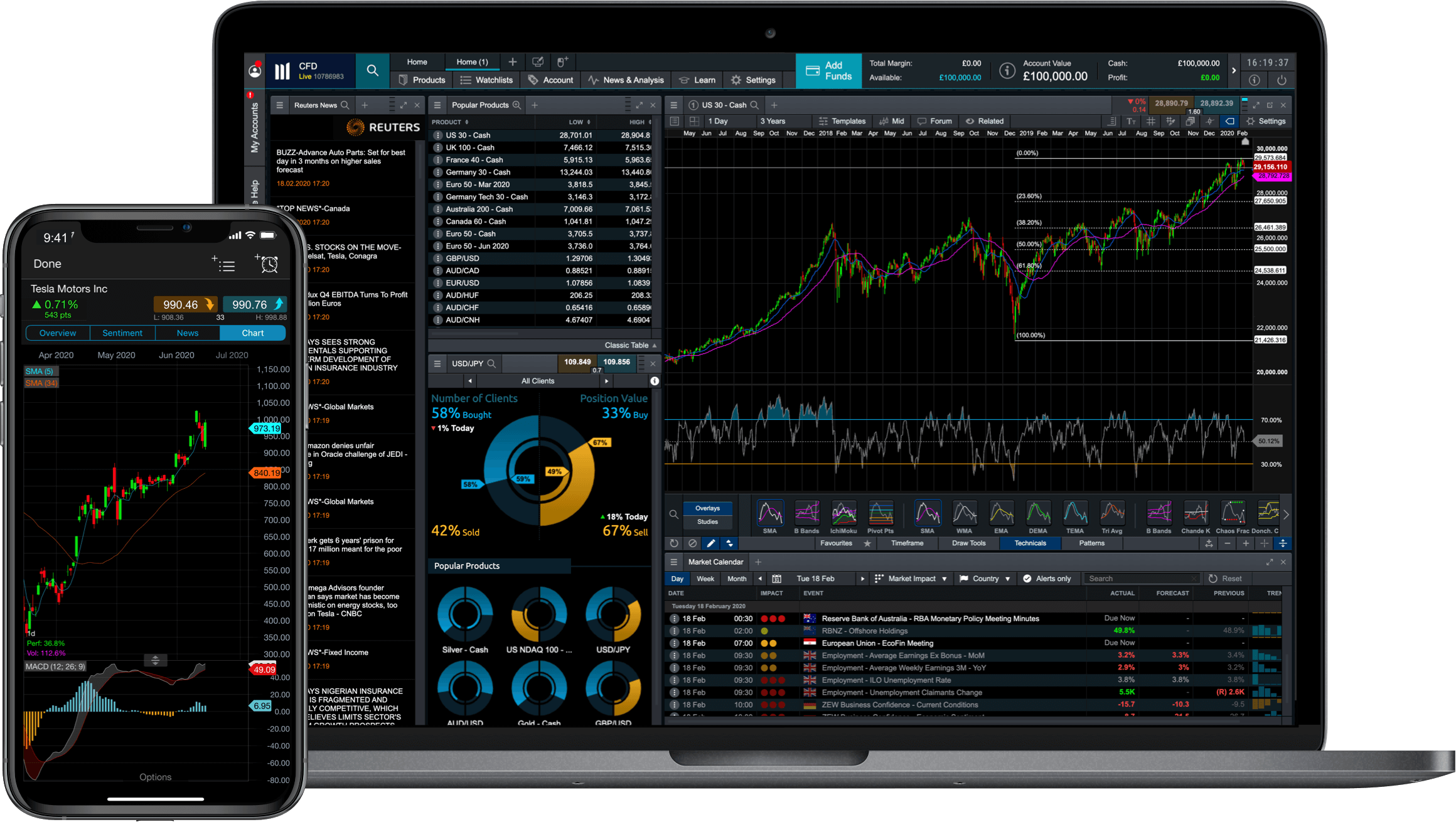

CFD trading has become increasingly popular among investors. It allows traders to speculate on the price movements of various financial instruments without owning the underlying assets. Essentially, CFDs mirror the movements of assets such as stocks, commodities, or indices, enabling traders to profit from both rising and falling markets.

The concept may seem complex, but it basically involves entering into a contract with a broker. If the price moves in your favor, you earn a profit equivalent to the change in asset value. Conversely, if the price moves against you, you incur a loss. Given its speculative nature, CFD trading requires keen understanding and strategic planning.

Why Interest Rates Matter in CFD Trading

Interest rates play a crucial role in the financial market, impacting various aspects of trading. For CFD traders, changes in interest rates can significantly influence market dynamics. Central banks, like the Federal Reserve, set these rates, affecting borrowing costs, consumer spending, and overall economic health.

When interest rates rise, borrowing becomes more expensive. This can lead to reduced consumer spending and slower economic growth, potentially causing asset prices to drop. For CFD traders, this means opportunities to short-sell and profit from declining asset values. On the flip side, falling interest rates can spur economic activity and drive up asset prices, presenting opportunities for long positions in CFDs.

How Interest Rates Affect Leverage in CFD Trading

Leverage allows CFD traders to control larger positions with a smaller capital outlay. While this can amplify profits, it also magnifies losses. The cost of leverage, known as the overnight funding rate, is directly tied to prevailing interest rates.

When interest rates are high, the overnight funding costs increase, making it more expensive to hold leveraged positions. Traders must weigh the potential benefits against higher costs, which can affect their overall strategy. Conversely, lower interest rates reduce funding costs, making it more attractive to use leverage in CFD trading.

Strategies to Mitigate Interest Rate Risks in CFD Trading

Effective risk management is essential for successful CFD trading, especially in fluctuating interest rate environments. One approach is to diversify your portfolio, spreading investments across various asset classes to minimize exposure to any single market.

Another strategy involves using stop-loss orders to automatically close positions at predetermined levels, limiting potential losses. Additionally, traders can monitor central bank announcements and economic indicators to anticipate interest rate changes and adjust their strategies accordingly.

Conclusion

Interest rates have a profound impact on CFD trading, influencing market movements and the cost of leverage. Understanding these dynamics can help traders make informed decisions, manage risks, and capitalize on opportunities. By staying informed and adopting strategic approaches, CFD traders can navigate the complexities of interest rate fluctuations and enhance their trading outcomes.